The global Debt bomb is ticking and getting unbearable day by day, Debt to GDP ratio is getting over 100% for most of the developed nations, and this economic crunch is due to a huge shift in economic turn down post-pandemic effects. We will be discussing in detail, the effects of the debt bomb and the circular debt system caused by it.

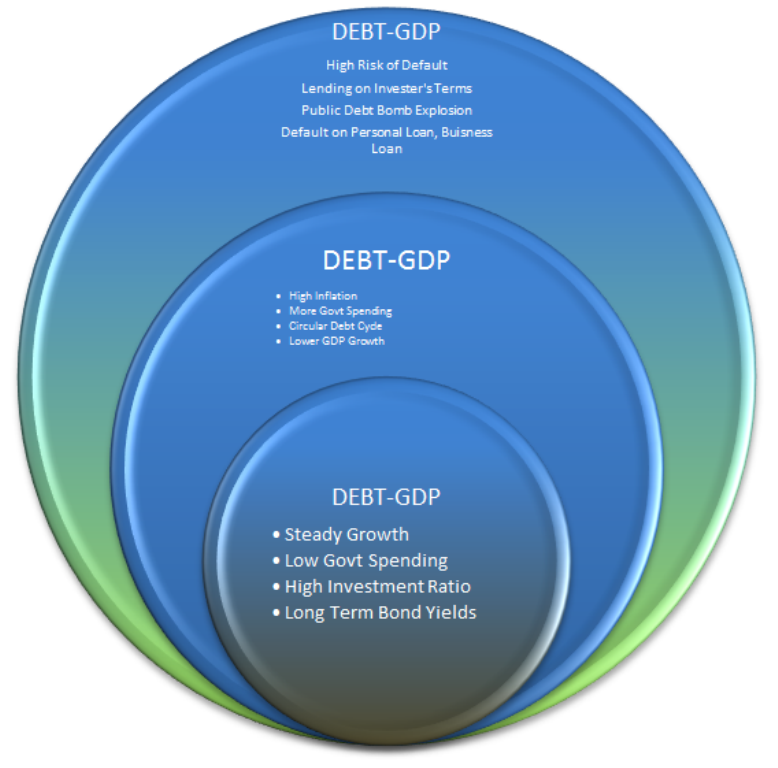

The Debt-GDP ratio defines the capability of a country to repay its foreign debts, and treasury bonds with a good yield on basis of strong economic growth measured by Gross Domestic Product (GDP). When a country has an achievable Debt-GDP ratio, investors are anxious to invest hoping for good returns in the long and short terms.

How does it Affect Us?

The economic growth of the country deeply relies on the tendency of its central bank to repay foreign loans and bond interest, and profit payments on time. Governments have always an opportunity to do reforms in regulations and financial workflow to improve Debt-GDP ratio, the important part is that GDP is highly dependent on manufacturing and exports of the country, and importing non-essential items can initiate the DEBT-GDP ratio near 100%, in a study by World Bank, a country may increase its chances to default on its payments if its Debt-GDP ratio exceeds and persists more than 77%, rising the level of its liabilities.

For manufacturing getting the order in post-economic order is much more difficult as producers need to meet the sales rates to win over their competitors, by reducing their cost, bulk buying of raw materials, local production of low-cost raw materials, and importing less machinery for any necessary expansions. When economic growth gets below the mark, the government have to supply goods, and raw material for any sort of manufacturing by importing it against foreign currency itself or private vendors.

Therefore economic growth or the rate of manufacturing increases for exports, and imports increases, increasing the public debt as well. By importing basic raw materials, and goods, government borrowing increases, and a pile of debt tend government to get delay its repayments. Maintaining the ratio is as important to balance the trade gap between the import and export of the country, so that unit import should be filtered by necessary machinery, raw food imports, medicine, etc.

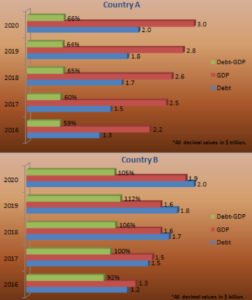

Investors always keep eye on a country’s repayment ability or its debt owed to international finance players, Banks are happy to give long-term loans for a good repaid reputation, for example, Country A has minimum chances of default as its Debt-GDP debt ratio is steady and significant growth in GDP, while Country B is near to default as the rate of its Debt is very high in comparison with the rate of growth of GDP.

A country taking debt up to or more than 100% of its producing goods value, then the debt has always been termed as a timing bomb that may sink the country’s wealth, economic conditions, household expenditures, and essential welfare spending upon explosion, by reducing the international finance agency ratings and prediction reports.

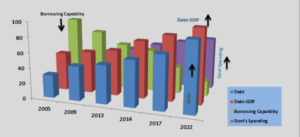

If we take an example of a country’s economy and analyze 10-20 years of economic data on percentage and balance of ratios, we may say as per the below graph that the Country’s borrowing capability is inversely proportional to the Debt-GDP ratio and its expenditures. Also, the gap between the Debt and Debt-GDP ratio indicates that country’s manufacturing, and producing goods like essential crops, and agriculture abilities have declined over the years.

These factors have also indicated that in an aerial economy watch over the years, regulators have failed to implement policies that can enhance the country’s revenue or innovation, and technology to reduce non-essential expenditures of the state.

Recession:

As the country’s economic growth slows down, the ability of the general public to repay the loans, i.e. vendors, manufacturers, businesses, and personal loans drops, which tends them to file for possible bankruptcy or reschedule their loans. People lose jobs due to closures and in this scenario government needs to spend more despite having low earnings through local taxation and loans. Low collection taxes tend the government to lower the aspected growth no. in every tax collecting sector and which eventually shakes the investor’s confidence.

Understanding the Circular Debt:

The government may get short of liquidity and each government department may get cut in budgetary funds forcing them to fail to pay their owed bills, and services to each other. This cycle of non-paying liabilities funds as per books is called Circular Debt. This debt cycle is important for a country’s GDP estimation to do the fraction of profit and non-profit state-owned entities.

This fraction also helps in differentiating services and non-services departments because short of liquidity may force the government to bear the burden of service departments which have to manage their profits and liabilities themselves leaving the state to focus on people welfare departments against the tax collected by them.

Possible Solutions & Conclusion:

The country’s expansion growth may also increase the country’s foreign lending bills but maintaining a balance in Debt-GDP ratio can follow the positive indicators for investors, financial organizations, and banks to support the country in its sales orders for export, fulfilling the country’s demand for consumables i.e. wheat, rice, and other food ingredients.

Measuring the yield for long or short-term investments in the country’s bond is the only parameter for international players, unlike the U.S which is very fortunate in this scenario where long or short yield matters for investors as in the case of world economic disorder, supply-demand disturbances, Banks getting defaults on their payments, USD is the safest investment for all international investor whose yield value is always sustainable.

Solutions to this situation in most of the developing countries in today’s world may vary with respect to time but have long implications over the year of designing fiscal policies of any country. Currently, the below steps can be taken to design financial policies for improvement.

- Keeping the environmental aspects in view for designing the fiscal, and monitoring policies for the next 10 years as global weather changes have changed the course for possible requirements, necessities, availability of raw material, and cost of setting up the manufacturing plants, and their operations.

- A country should own foreign assets to make good lending deals of possible mortgages, for example, japan has a GDP ratio of nearly 101% but it has a unique way to tackle this financial situation because most of its lending is inside the country from foreign and private banks where it has great no. of foreign asset holdings in several developed countries.

- Research and development in the consumables field where a country should increase its productivity of crops, raw materials for manufacturing, and food essentials. The country has a larger no, of exports as compared to imports can increase the growth rate and GDP.

- The policy should be made to enhance opportunities for small investors to set up manufacturing plants with R&D budgets supported by state-owned institutions.

- Government should consider implementing the latest technology to reduce state spending on non-service departments. i.e. reduction in paper use, electrical vehicle policies for more fuel usage countries, and Artificial Intelligence-based operations where tracking and sorting can reduce time to achieve more efficiency.

- Implementing an effective taxation system with more focus on tracking system rather than plenties based structure where taxpayers are more worried to get a chance to avoid plenties.

The above article has explained in detail how a country can differentiate between its demand, necessities, and revenue to compare the Debt, GDP, and growth rate and design a long-term high yield-based finance policy with financiers’ confidence to achieve a steady growth rate in the country’s revenue.